The complete fundraising platform

We built CQ because we've raised capital ourselves. We know the pain of cold outreach, scattered tools, and 18-month fundraises. CQ is the platform we wish we had—covering all 8 stages from LP discovery to close.

Our Team's Track Record

Level the playing field

Large funds with established networks close in months. First-time managers spend 18+ months cold-emailing LPs who will never respond.

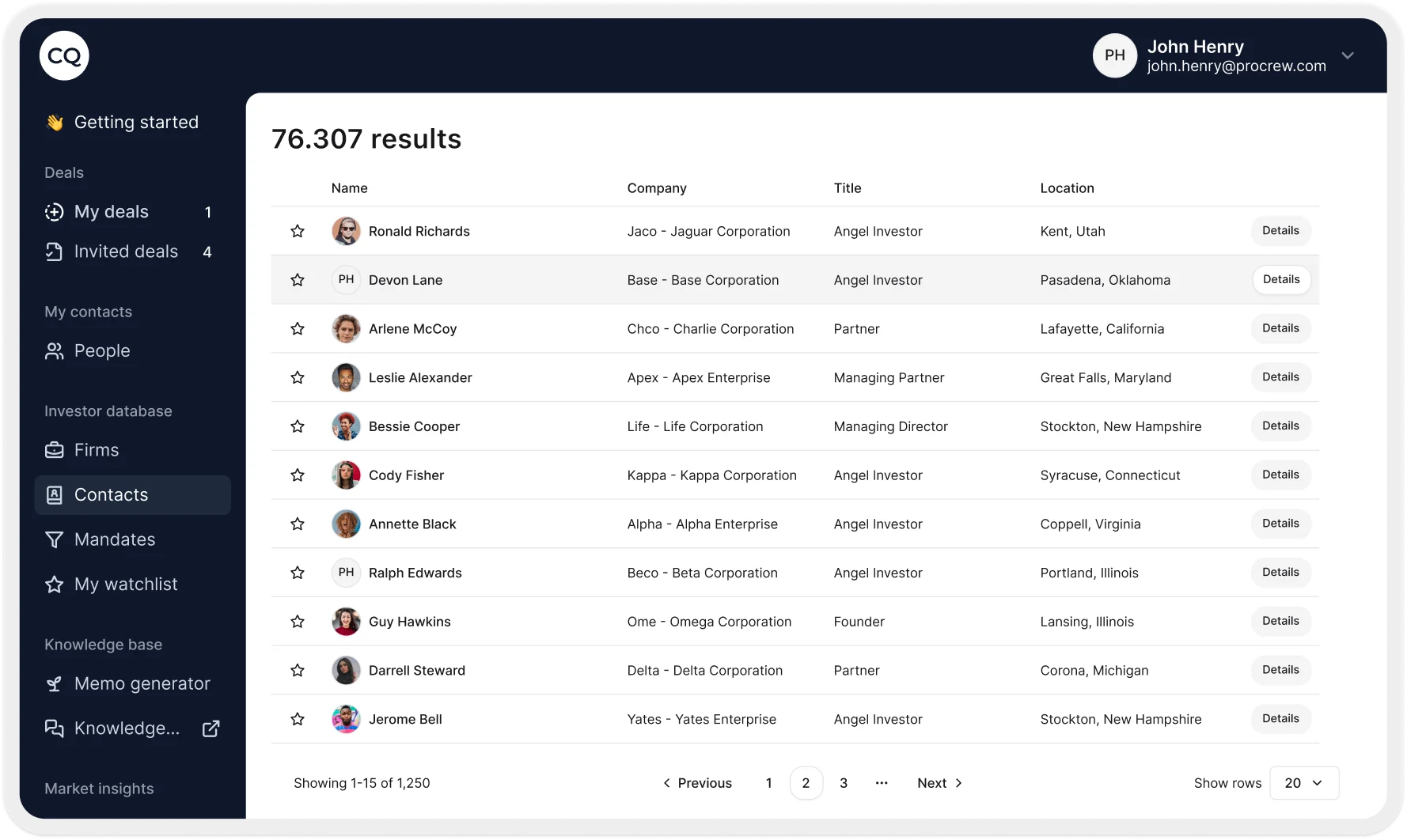

CQ is the only platform covering all 8 stages of fundraising—from LP discovery and AI matching to cold email, data rooms, NDA signing, and commitment tracking. No more juggling 6+ tools.

The result? Our customers find qualified LPs in days, not months. They close 2x faster and spend their time on what matters: building great portfolios.

Erik Ford

Founder & CEO

Erik has been on both sides of the table—as a fund manager who deployed $455M+ through Renn Global and as an operator who built three companies to successful exits totaling $800M+.

He built CQ because he watched first-time managers struggle with the same LP outreach and data room challenges that shouldn't be barriers to raising capital.

Company Builder

- Kaizen Platform – COO through IPO ($500M+ peak market cap)

- Boost Media – VP BD (Acquired by AdLabs)

- Triad Retail – Director (Acquired by WPP for $300M+)

Investor & Operator

- Renn Global – Founder/CEO – $455M+ invested

- Led Japanese JV partnership with $15B partner

- Former Raymond James & Wells Fargo (Top 10 wealth teams)

What you can count on

Built for Fund Managers

Every feature designed specifically for emerging managers raising $10-150M funds.

AI That Actually Works

LP matching, due diligence, and Q&A powered by AI trained on real fundraising workflows.

Your Data Stays Yours

Your LP data is never shared or used to train AI models. We take data privacy seriously.

Real Support

Dedicated support from people who understand fundraising—because we've done it ourselves.

Ready to raise your next fund?

Access 150K+ investors and 95K+ asset managers. Start free today.