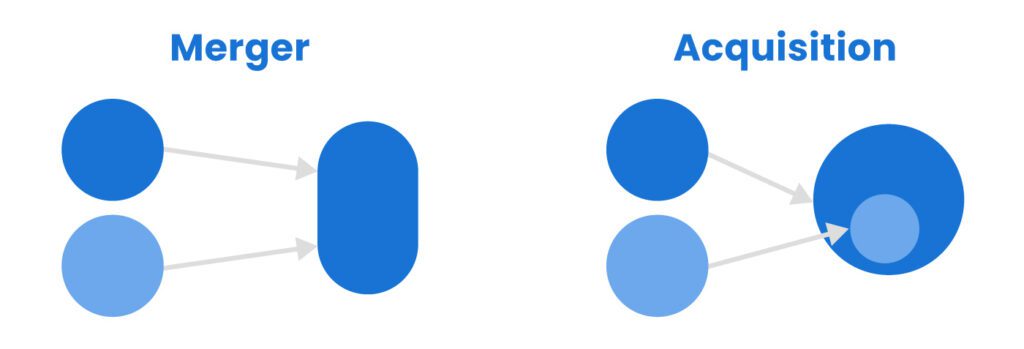

The asset management industry is undergoing significant transformation, driven by mergers and acquisitions (M&A). As firms seek to scale operations, enhance investment capabilities, and adapt to shifting market dynamics, consolidation has become a strategic priority. This article explores the trends shaping M&A in asset management, key drivers, notable transactions, and the implications for investors, firms, and clients.

Here’s a more detailed, informative, and engaging version of your content with additional insights:

Table of Contents

- The Rising Momentum of Mergers & Acquisitions in Asset Management

- Key Drivers Behind M&A Activity in Asset Management

- Notable Mergers and Acquisitions Transactions in Asset Management

- Benefits and Risks of M&A in Asset Management

- Executing a Successful M&A Deal in Asset Management

- The Future of Asset Management in Mergers and Acquisitions: Strategic Shifts Reshaping the Industry

- The Firms That Will Thrive in the Next Decade

- Final Thoughts

The Rising Momentum of Mergers & Acquisitions in Asset Management

Over the past decade, mergers and acquisitions (M&A) have become a dominant force reshaping the asset management industry. From boutique firms to global powerhouses, asset managers are increasingly turning to M&A as a strategic lever to accelerate growth, diversify offerings, and streamline operations.

Multiple factors are driving this consolidation trend:

- Regulatory complexity across jurisdictions

- The shift toward passive and alternative investments

- Rising technology costs and digital transformation

- Increasing demand for global scale and product breadth from institutional investors

- 2015: Fidelity Investments recorded 89 M&A transactions involving registered investment advisors (RIAs), with acquired client assets totaling $130 billion.

- 2019: The industry experienced one of its most active years, with deal volumes fluctuating between approximately 80 to 110 completed transactions per year, barring the two most active years on record.

- 2021: Set a 10-year record for global M&A activity in wealth and asset management.

- 2022: Despite a projected 42% drop in deal value, deal volume increased by 13%, reflecting a trend toward smaller average deal sizes.

2023: The number of M&A transactions within the investment and wealth management sectors experienced a downturn following two successive years of growth.

This surge reflects a structural evolution in the asset management landscape. As the industry faces margin compression, fee transparency, and client demands for digital experiences, consolidation is no longer just a growth tactic – it’s a survival strategy.

Firms that embrace operational integration post-acquisition, leverage AI for back-office synergy, and standardize investor communications are best positioned to extract value from M&A. In this new era, operational excellence post-merger will define competitive advantage.

Key Trends Shaping Asset Management M&A

- Cross-Border M&A and Global Expansion

- As firms seek to expand their market presence, cross-border transactions have become increasingly prevalent.

- Asset managers are acquiring firms in emerging markets to access new capital sources and diversify investment strategies.

- Regulatory harmonization in certain regions, such as the European Union, is facilitating more cross-border deals.

- Technology-Driven Acquisitions

- The rise of fintech, AI, and automation is driving asset managers to acquire tech-focused firms to stay competitive.

- Traditional investment firms are integrating robo-advisors, AI-powered analytics, and blockchain solutions to enhance efficiency and client experience.

- Digital transformation is no longer optional – firms that fail to adapt risk falling behind more technologically advanced competitors.

- Private Equity’s Growing Influence in Asset Management

- Private equity (PE) firms are playing a significant role in consolidating asset managers, targeting undervalued firms with high growth potential.

- PE-backed acquisitions focus on optimizing operational efficiencies and profit margins, making asset management firms more scalable.

- The ability of private equity to unlock capital, streamline operations, and implement cost-cutting measures is reshaping the industry.

- The Shift Toward Passive Investing and ETFs

- Investors are increasingly favoring low-cost, passive investment vehicles such as exchange-traded funds (ETFs) and index funds.

- Active managers are under pressure to adapt or acquire passive investment firms to remain competitive.

- Firms specializing in active strategies are acquiring passive investment firms to diversify offerings and retain market share.

Key Drivers Behind M&A Activity in Asset Management

1. Competitive Pressures and the Need for Scale

- Larger firms benefit from economies of scale, allowing them to lower operational costs and improve profitability.

- As competition intensifies, asset managers are merging to enhance market positioning and distribution capabilities.

- Consolidation helps firms streamline investment operations, reduce redundancies, and increase cost efficiency.

2. Changing Investor Expectations and Market Dynamics

- Institutional and retail investors are demanding lower fees, greater transparency, and personalized investment solutions.

- Mergers and acquisitions enable firms to expand their offerings, integrate Environmental, Social, and Governance (ESG) strategies, and introduce more tailored investment products.

- Investors favor firms that can provide data-driven insights, alternative asset exposure, and next-generation financial tools.

3. The Role of Technology and Innovation

- AI, big data analytics, and automation are revolutionizing investment management, making mergers and acquisitions a critical pathway for firms lacking in-house technological capabilities.

- Acquiring firms with proprietary trading algorithms, machine learning-driven portfolio models, and risk management platforms enhances competitive advantage.

- The growing demand for real-time investment insights and predictive analytics is fueling mergers and acquisitions in asset management technology.

4. Evolving Regulatory Landscape

- Regulatory changes are prompting firms to consolidate and pool resources to better navigate compliance requirements.

- Increasing regulations on financial reporting, ESG disclosures, and anti-money laundering (AML) policies have made M&A an attractive solution for firms needing enhanced compliance infrastructure.

- Governments worldwide are tightening rules around cross-border investments and fund structures, making regulatory expertise a key factor in M&A transactions.

For more insights about Asset Management Industry, explore: Top 8 Investor Databases For U.S. Asset Managers In 2025

Notable Mergers and Acquisitions Transactions in Asset Management

Recent high-profile deals highlight the strategic motivations driving industry consolidation:

1. Blackstone’s $4 Billion Sale of First Eagle Investment Management

- Blackstone divested its stake in First Eagle Investment Management in a $4 billion deal, reflecting the increasing role of private equity in reshaping the asset management industry.

- This move aligns with Blackstone’s strategy to reallocate capital into high-growth alternative investment segments.

- The transaction highlights the ongoing trend of private equity involvement in asset management M&A.

2. Suspended Merger Talks Between Allianz and Amundi

- Allianz and Amundi engaged in merger discussions to create one of Europe’s largest asset management firms.

- Talks ultimately stalled due to valuation concerns and strategic misalignment, underscoring the complexities involved in large-scale Mergers and Acquisitions deals.

- This case illustrates the challenges of integrating large, multi-faceted asset managers with differing investment philosophies.

3. Morgan Stanley’s Acquisition of Eaton Vance

- Morgan Stanley acquired Eaton Vance for $7 billion, reinforcing its expansion into active investment management and fixed-income strategies.

- The deal allowed Morgan Stanley to diversify its portfolio with high-net-worth client-focused investment solutions.

- This move exemplifies the growing preference among financial giants for acquiring boutique asset managers with specialized investment expertise.

Benefits and Risks of M&A in Asset Management

For Acquiring Firms

- Strategic Expansion: Gaining access to new client segments, markets, and investment capabilities.

- Operational Synergies: Cost savings through technology integration and streamlined operations.

- Brand Enhancement: Strengthening market position and global reach.

For Target Firms

- Growth Opportunities: Access to larger distribution networks and capital resources.

- Challenges in Cultural Integration: Differences in corporate culture can lead to integration difficulties.

- Regulatory Hurdles: Compliance with different jurisdictions’ financial regulations can complicate mergers.

Impact on Clients and Investors

- Improved Product Offerings: A wider range of investment solutions and strategies.

- Potential Disruptions: Changes in investment philosophy and fund management styles may affect portfolio performance.

- Fee Structures: Mergers can lead to fee reductions due to economies of scale but may also result in cost-cutting measures that impact service quality.

Executing a Successful M&A Deal in Asset Management

A well-structured approach is crucial for maximizing the benefits of M&A transactions. Key steps include:

Strategic Planning and Target Identification

Firms must clearly define their objectives, whether they seek market expansion, new investment capabilities, or cost synergies. Identifying the right target that aligns with long-term strategy is essential.

Due Diligence and Risk Assessment

Thorough financial and operational due diligence is essential when evaluating potential mergers and acquisitions in asset management. Investment firms must assess revenue streams, compliance risks, fund structures, and operational synergies before proceeding with a transaction.

AI-powered platforms like CQ streamline this process by enabling real-time risk assessment, automated document analysis, and investor tracking, ensuring that fund managers and asset allocators make data-driven, informed decisions throughout the deal lifecycle.

Negotiation, Deal Structuring, and Integration

Structuring anMergers and Acquisitionsdeal effectively requires a strategic approach to negotiations, capital commitments, and operational consolidation. Firms must:

- Align investment strategies to ensure a seamless transition of assets and fund management responsibilities.

- Optimize client and investor communications to maintain trust and transparency throughout the process.

- Develop post-merger integration plans that unify compliance workflows, reporting structures, and fund administration across merged entities.

Properly structured transactions reduce operational friction, mitigate regulatory risks, and enhance long-term portfolio performance.

The Future of Asset Management in Mergers and Acquisitions: Strategic Shifts Reshaping the Industry

Mergers and acquisitions (M&A) in asset management are no longer just about scale and cost synergies – they are driven by fundamental shifts in investor behavior, regulatory pressures, and technological disruption. As the financial landscape undergoes rapid transformation, firms that fail to adapt will struggle to remain competitive. The next wave of consolidation will be shaped by five key strategic imperatives that go beyond conventional M&A motives.

1. The AI-Powered Asset Manager: From Cost Efficiency to Alpha Generation

AI is no longer just a cost-cutting tool, it is becoming a competitive differentiator in investment decision-making, client servicing, and operational scalability. The firms that thrive in the next decade will be those that acquire and integrate AI-native asset managers rather than retrofitting legacy systems.

Key Trends Driving AI-Driven Mergers and Acquisitions

- Beyond Automation: While AI-powered automation improves compliance, risk modeling, and reporting, the real value lies in AI-driven alpha generation, where machine learning optimizes factor investing, quant strategies, and alternative asset allocations.

- Data as an Asset: The future winners in asset management will be firms that own proprietary datasets, acquiring data-rich investment platforms and AI-driven analytics firms will be a core M&A strategy for forward-thinking asset managers.

- Personalization at Scale: AI-powered investment platforms are making hyper-personalized portfolio management accessible to institutional investors and high-net-worth clients. Acquiring fintech-driven AI platforms will allow traditional firms to scale customization without increasing costs.

Firms that fail to invest in AI-native acquisition targets risk becoming obsolete as algorithmic decision-making and AI-driven portfolio management become the industry standard.

2. The Rise of Private Equity Dominance in Asset Management

Private equity (PE) firms are no longer just investors in asset managers, they are becoming asset managers themselves. The aggressive buyout strategies seen over the past decade are accelerating, as PE firms look to diversify revenue streams, extract operational efficiencies, and expand into alternative asset classes.

Why PE-Backed Asset Managers Will Lead the Next M&A Wave

- Capital Efficiency & Leverage: Private equity firms optimize fee structures, capital efficiency, and leverage, making them more profitable than traditional publicly traded asset managers.

- Focus on Alternative Assets: The majority of capital growth in asset management is shifting towards private equity, venture capital, infrastructure, and private credit, areas where private equity firms already dominate.

- Exit Strategies via M&A: Instead of taking portfolio companies public, private equity firms increasingly consolidate them into larger multi-asset management platforms, providing higher-value exit without IPO risks.

As PE firms aggressively acquire asset managers, traditional fund houses must rethink their competitive positioning.

3. The Death of Standalone Active Management: The ETF & Passive Investing M&A Surge

The shift from active to passive investing is one of the most disruptive forces in asset management. Over 50% of U.S. equity assets are now in passive funds, forcing active managers to either pivot or acquire ETF and index fund providers to maintain relevance.

What This Means for Mergers and Acquisitions

- Vertical Integration of ETFs: Traditional asset managers will increasingly buy ETF issuers rather than compete with them, ensuring they retain control over AUM inflows.

- Direct Indexing & Customization: Personalized passive investing is gaining traction, leading to acquisitions of direct indexing firms that allow ultra-customized passive strategies.

- Fee Compression Survival: Passive investing has eroded fee margins in active management. Asset managers must scale through M&A to remain profitable.

Asset managers that resist the shift toward passive and hybrid investment models risk becoming obsolete in an era where investors demand low-cost, tax-efficient, rules-based strategies.

4. ESG & Impact Investing: Mergers and Acquisitions as a Competitive Moat

Sustainability is no longer a niche investment theme, it is a core capital allocation strategy for institutional investors, sovereign wealth funds, and pension funds. However, scaling ESG investment strategies requires acquiring specialized expertise, leading to a surge in M&A deals focused on sustainability-driven asset managers.

Why ESG-Focused Mergers and Acquisitions is Gaining Momentum

- Greenwashing vs. Genuine Impact: Acquiring ESG-native asset managers provides credibility in a world where greenwashing concerns are eroding investor trust.

- Regulatory Compliance & Reporting: ESG reporting mandates, such as EU SFDR and SEC climate disclosure rules, require specialized compliance frameworks that not all asset managers have in-house.

- Carbon Markets & Impact Investing: The rise of carbon credit funds, biodiversity investments, and sustainability-linked private equity is driving consolidation in impact-first investment firms.

The firms that lead the ESG-driven Mergers and Acquisitions trend will secure long-term capital inflows from institutional investors prioritizing sustainability-linked returns.

5. The End of Legacy Asset Management: Tech-First Firms Will Dominate

The asset managers of the next decade will not look like those of the past. The next phase of Mergers and Acquisitions will see tech-first asset management firms acquiring legacy players, not the other way around.

The Tech-Driven Future of Asset Management M&A

- Tokenization of Assets: Blockchain and digital asset platforms will drive the next wave of fund structuring and liquidity solutions, making traditional fund structures obsolete.

- AI-Driven Investor Relations: Asset managers that acquire AI-powered investor engagement platforms will control capital-raising and LP communications at scale.

- Seamless Alternative Asset Access: Private markets will become as accessible as public markets, with fintech acquisitions enabling fractional ownership and secondary trading of private equity, real estate, and venture capital.

Traditional firms that fail to integrate tokenization, AI-driven client servicing, and next-generation investment structures through M&A will struggle to compete with new digital-first asset management giants.

The Firms That Will Thrive in the Next Decade

Asset managers that proactively engage in strategic acquisitions and technology-driven integrations will dominate the next era of finance. The most successful firms will be those that:

✔ Acquire AI-native investment firms to stay ahead in data-driven alpha generation

✔ Expand into private equity and alternatives, aligning with long-term capital growth trends

✔ Secure dominance in passive investing through ETF and direct indexing acquisitions

✔ Strengthen ESG credibility via sustainability-driven Mergers and Acquisitions strategies

✔ Adapt to the tech-first era by acquiring digital-native investment platforms

The next decade of asset management M&A will be defined by those who embrace change rather than resist it. Firms that fail to adapt will find themselves on the wrong side of financial history.

Final Thoughts

The asset management industry is undergoing a major transformation, with Mergers and Acquisitions activity playing a central role in reshaping competitive dynamics. Firms are leveraging consolidation strategies to enhance scale, integrate AI-driven investment solutions, and meet investor demands for innovation and efficiency.

As the industry moves forward, firms that embrace digital transformation, align with investor preferences, and leverage strategic M&A partnerships will emerge as leaders in the evolving financial ecosystem.

For asset managers looking to stay ahead in a rapidly evolving landscape, embracing M&A with a data-driven approach is key. Connect with CQ today to discover how AI-driven insights can transform your M&A strategy.

May you also like: