Let AI Supercharge

Your Fundraise.

The only platform that takes you from LP discovery to signed commitment. Built by fund managers who use it for our own raises.

The only platform covering all 8 stages

Most tools cover 2-3 stages. We cover the full funnel.

From first search to final close

Step 01

Find the right LPs

Search 150K+ LP profiles by check size, sector, and geography. AI ranks matches by fit-build a list in minutes.

- 50K+ verified contacts

- Mandate matching

- AI fit scoring

Step 02

Reach out and engage

Launch AI-powered cold email sequences. Share your data room securely-AI answers LP questions 24/7.

- AI cold email

- 24/7 AI concierge

- 10 hrs saved weekly

Step 03

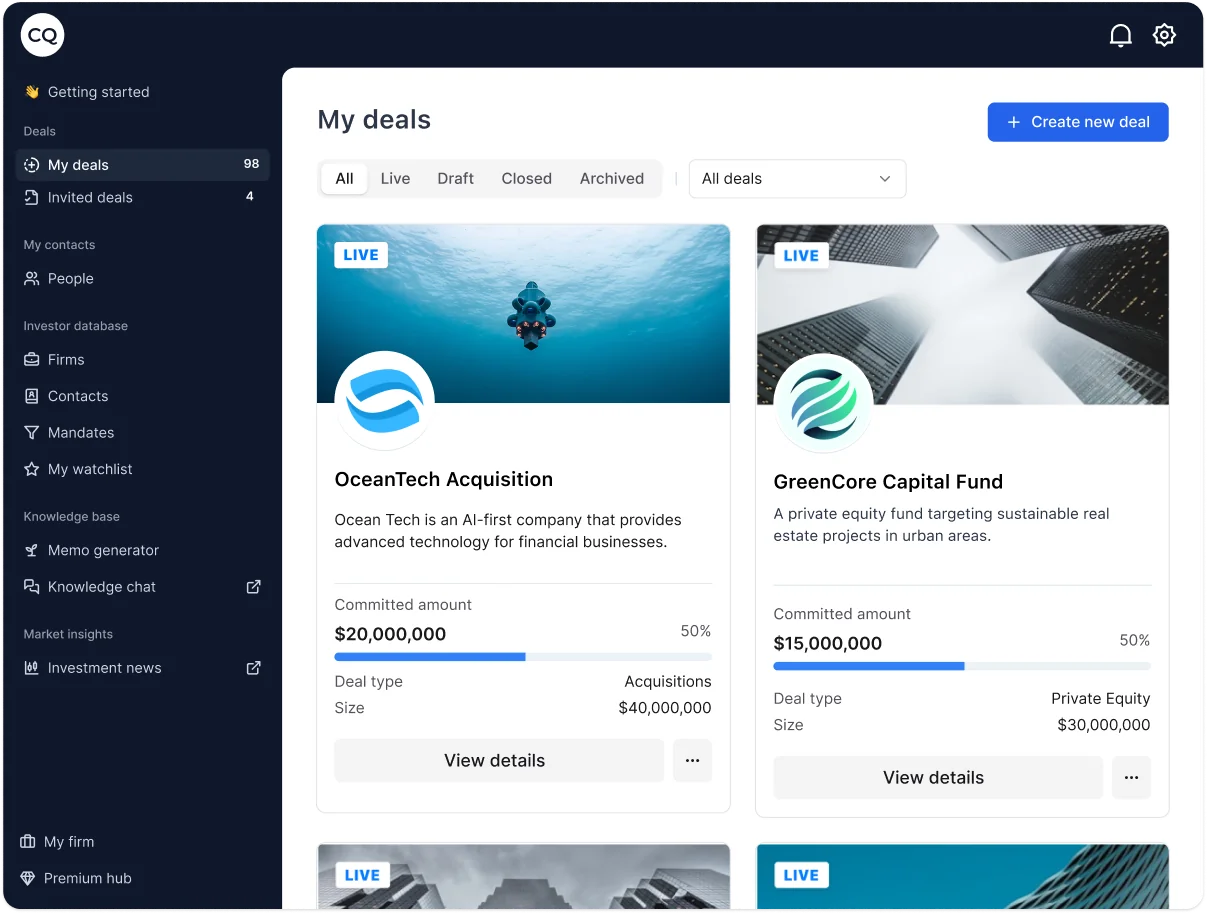

Close with full visibility

NDAs sign themselves. LPs explore your deal in a clean portal. Track every commitment from soft-circle to signed.

- Zero NDA chasing

- LP portal

- 2x faster closes

We use CQ for our own raises

Built by an asset manager. Battle-tested on real fundraises.

Invested

by our team

Deals

closed by our team

LP Profiles

in database

Ready to close your fund faster?

Start free. See LP matches in minutes. No credit card required.